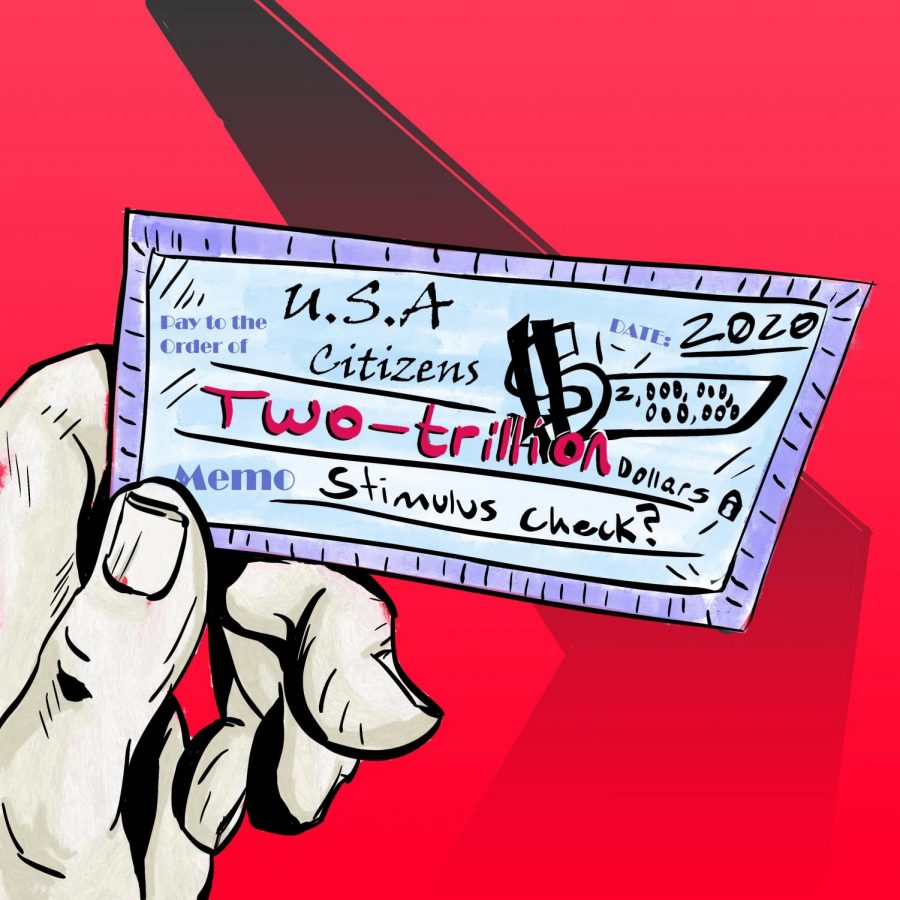

College students ignored in stimulus relief bill

April 17, 2020

The United States congress came to a decision and passed a stimulus relief bill for U.S. citizens. The stimulus relief bill commits an unprecedented $2 trillion in civilian aid with $250 billion reserved for paying the workforce of the U.S.

The bill goes on to explain that individuals who earn $75,000 in adjusted income or less will receive $1,200 each. Married couples that earn up to $150,000 will receive $2,400 and if the married couple has children, they will receive $500 for each child who is 17 years of age and younger.

The payments, however, can be expected to be lowered for individuals who make more than $75,000 and those who make more than $99,000 should not be expecting any type of government relief from this bill. This threshold is doubled for those who are married.

The qualifying income levels will be based on tax returns that were filed in 2019, if they have been filed already, or 2018’s tax returns.

90% of Americans will be eligible to receive full or even partial payments according to the Tax Policy Center.

This stimulus bill will help the majority of this country through a time that has been labeled “the new normal,” however an entire demographic has been disregarded by this bill. This demographic is the average college student.

The average college student has an age range of 18-22. In these times, most people who fit this age range are still claimed as dependents on their parents’ tax returns, meaning they will not be eligible to receive any additional aid outside of any unemployment funds from the government.

Stela Ramirez, a senior human services major, is one of the few outliers who qualify for the stimulus relief.

“From what I researched, I am eligible for the full amount of $1,200, plus the $500 for my daughter,” Ramirez said in response to a Facebook post.

Larry Gonzales Sr., a sophomore sociology major, thinks that the stipulations for receiving this stimulus aid might be too strict.

“Regardless of age in my opinion, if we attend college, file our taxes, we should receive this help,” Gonzales said in response to a Facebook post.

Alissa Gomez, a fourth-year psychology major, also qualifies for the stimulus aid but does not plan on spending any of her money from the stimulus relief immediately.

Based on a poll on The Runner’s Instagram account, 71% of students who answered the poll said they did not qualify, whereas only 29% of students who answered the poll said they qualified.

Stimulus checks started rolling out on Monday, April 13. Those who have not yet received their stimulus checks will be able to track when theirs will either arrive in their bank accounts or in their mailboxes. On Friday, April 17, according to the IRS and U.S. Treasury department, there will be a “Get My Payment” tool available. This tool will be accessible on the IRS’s Economic Impact Payment webpage on the IRS website. This tool is intended to do the following:

Allow U.S. citizens to check the status of their check, so they will know approximately when it will reach their bank accounts or be mailed.

If they filed tax returns in 2018 and/or 2019 and did not provide direct deposit information –which means they either chose to receive their tax refund as a check, or didn’t receive a refund at all –they will be able to share this information with the IRS if they choose to do so.

If payment has not yet been issued, they can confirm whether they want to receive their stimulus funds by direct deposit or check. It is noted that choosing direct deposit will allow recipients to receive their funds faster.