Reporter

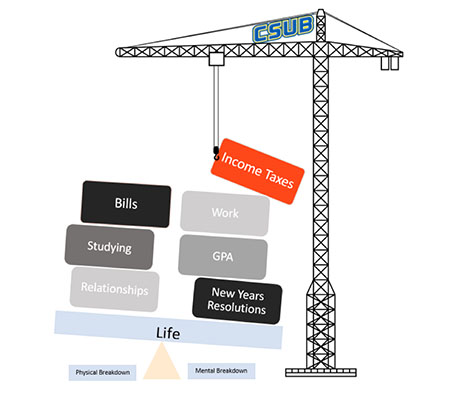

Picture this: A CSU Bakersfield student is sitting in the library trying to finish her first research paper of the semester, when she realizes she can’t ignore the TurboTax ads anymore.

She switches over to Google to see how much it costs. It’s $69.99. Panic ensues. She must pay $69.99 in addition to the $788 in student fees, those three parking tickets, that book she still needs and her computer that just broke. Eventually, she succumbs, knowing she has no choice, and buys TurboTax.

Just as she starts to calm down, tax hieroglyphics hit the screen. The W-2, the 1099, the 1098-T, the 1040, the 8606 and more crowd her brain. She can’t handle it. She’s not alone. For this story posted to Twitter, filing their taxes is seriously stressing them out. Approximately 11,250 students said that they are stressed.

Wouldn’t it be nice if there was someone to teach students how to file their taxes? What if that same person could explain how the student could get up to $2,500 back? And what if it was free? Guess what? It exists and it’s free for CSUB students, faculty and staff.

CSUB partnered with the Community Action Partnership of Kern’s, Volunteer Income Tax Assistance program, offering free income tax assistance. Every Saturday, through March 30, CSUB students can bring in a few documents and have one-on-one time with an IRS certified volunteer who will help file their taxes.

Dr. Benjamin Bae, faculty coordinator of CSUB’s VITA program said, “Free tax preparations provide students, staff, and faculty with complete tax returns in a timely fashion, enabling them to receive proper tax credits and refunds.”

Dr. Bae also said “services are totally free. It takes about one hour on average and estimate that CSUB VITA will serve about 250 clients this year.”

During the appointment one will learn about two main tax cuts for college students: the American Opportunity Tax Credit (AOTC), and the Lifetime Learning Credit (LLC). In a separate Twitter poll, over 6,000 students admitted they did not know about those credits.

To be eligible for AOTC, a maximum $2,500 credit, the student must:

•Be pursuing a degree or other recognized education credential.

•Be enrolled at least half time for at least one academic period.

•Not have finished the first four years of higher education .

•Not have claimed the AOTC or former. Hope credit for more than four tax years

•Not have a felony drug conviction.

If for some reason the student is not eligible, there is another option.

To be eligible for LLC, a maximum $2,000 credit, the student must:

•Be enrolled or taking courses at an eligible educational institution.

•Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills.

•Be enrolled for at least one academic period beginning in the tax year.

The average Bakersfield tax filer pays between $100 and $350 for this same free service. This is the VITA program’s third consecutive year at CSUB.

When asked about last year, Angappa Gunasekaran, Dean for the School of Business and Public Administration said, “The program was well received by the Bakersfield community and BPA is excited to be participating again this year.”

Not all students were aware of the program. Sociology major, Angela Barnes, said, “I didn’t know about this service or this tax credit and I missed out on money last year.” Dr. Bae said, “Unless students use professional services or get familiar with tax credits, the chance is high that they overlook or are unaware of this kind of credit.”

Call (661) 654-3406 to book an appointment with a certified IRS volunteer.